Big Tech Dominance Reshapes Global Advertising as Market Hits $1.19 Trillion

Alphabet, Amazon and Meta to control 58.8% of ad spending outside China by 2027

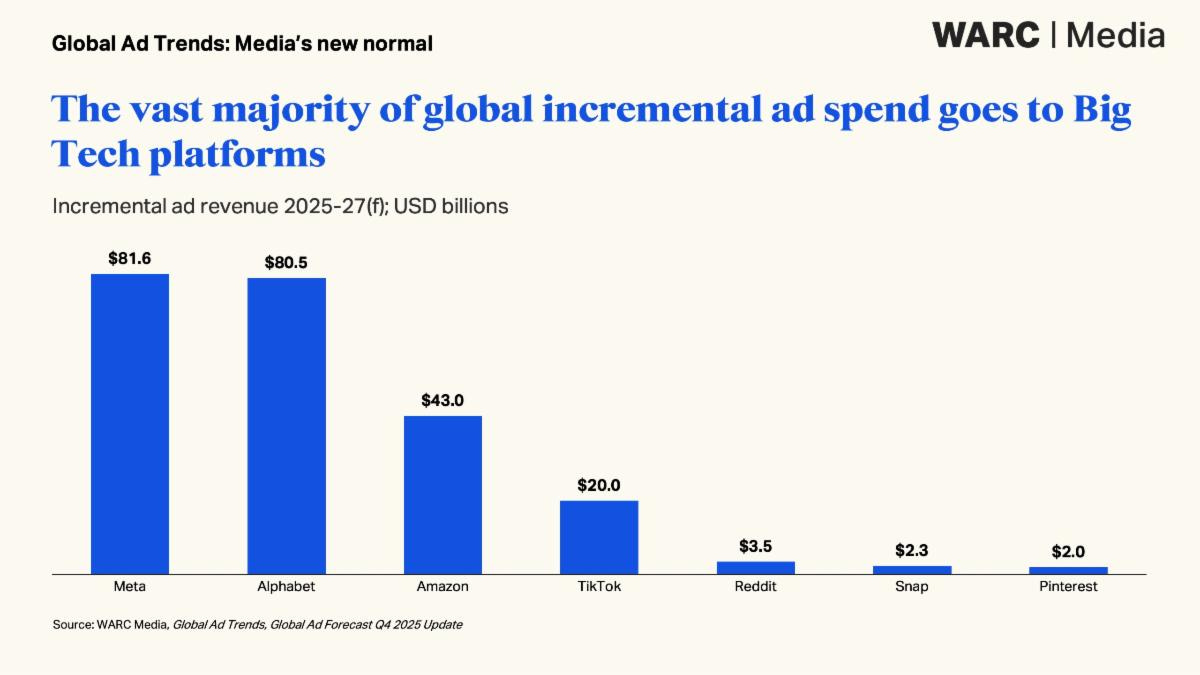

Three companies now control more than half the global advertising market. Alphabet, Amazon and Meta will take 56.1% of all ad spending outside China this year $556.6bn and their grip is tightening. By 2027, that share climbs to 58.8%.

The global advertising market will reach $1.19 trillion in 2025, up 8.9% and 1.5 percentage points above the WARC forecast predicted in September.

Next year brings another 9.1% jump to $1.30 trillion. By 2027, the market will reach $1.40 trillion, double its size in the pandemic year of 2020.

That’s equivalent to $150 spent for every person alive today.

Something fundamental has shifted. puts it bluntly: ”Advertising has broken away from the economic cycle, and behaves in a way that doesn’t feel reflective of the real economy. New money has arrived from digital-native categories, while commerce has redrawn the measured media map, and Big Tech’s self-reinforcing flywheel is harvesting almost all incremental dollars.”

Alex Brownsell, Head of Content at WARC Media

The numbers tell the story. Alphabet, Meta, and Amazon will capture the vast majority of new ad spending between now and 2027. Their share of the global market, excluding China, reaches 58.8% by the end of the forecast period.

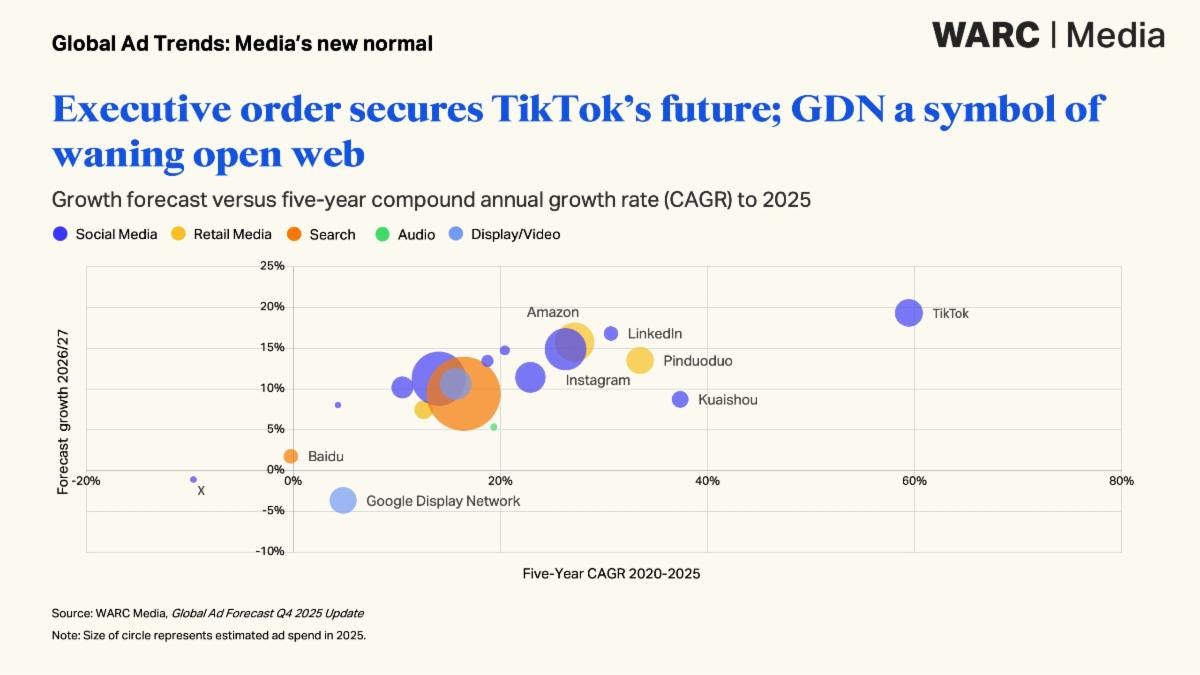

TikTok and Reddit are growing faster, but they’re fighting for scraps. TikTok will pull in $45.2bn by 2027 – less than a fifth of what Meta expects to make. An executive order signed in September 2025 removed uncertainty about TikTok’s future in the US, its largest market at approximately $12bn this year. Still, the platform’s rapid growth can’t match the scale of the established giants.

Big Tech’s scale advantage keeps compounding. The giants can outspend everyone on AI-driven optimisation, creative automation and first-party data infrastructure. Meta ploughs roughly 30% of quarterly earnings back into research and development, funding products like Reels and Advantage+ that pull in more advertisers. Amazon does the same – ad revenue growth feeds better data signals, which drive higher margins, which fund more investment.

The open web is paying the price. Google’s Display Network – still the world’s largest – will notch its third straight year of declining ad revenue in 2025. That trend continues through 2027.

More money now goes directly to the platforms. Fee layers are shrinking across the board – cheaper AI tools, tighter agency margins, lower ad-tech costs. Big Tech’s revenue grows even when total spending stays flat.

Here’s the odd bit: advertising is booming while the broader economy looks fragile. Real wages have stagnated in most developed markets. Inflation has eaten into purchasing power. Higher interest rates make borrowing expensive. Yet ad spending continues to climb, seemingly detached from the economic reality facing most consumers and businesses.

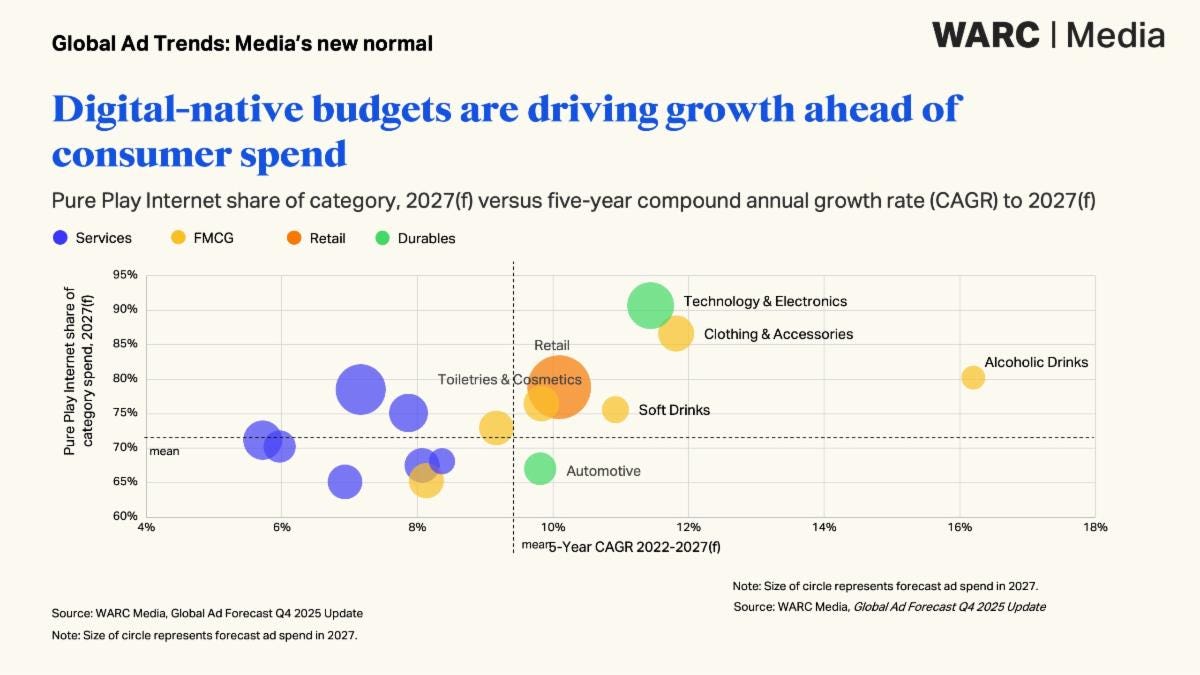

The disconnect reflects where the money’s coming from. Fast-growing sectors like cross-border eCommerce are investing billions in search, social, and retail media. Trade marketing budgets have shifted into measurable digital channels. Retail media now accounts for 14.7% of global ad spend, accelerating the shift to bottom-of-funnel tactics.

For big advertisers, growth comes more from price increases than volume. That makes brand-building more valuable even as consumer demand stays weak. WARC surveyed 1,093 marketing practitioners. Among those expecting bigger budgets next year, 51% plan to spend more on brand investment – a recognition that pricing power depends on brand strength.

Digital-native budgets have created a second growth engine. Small businesses, trade marketing funds and retail media networks have brought billions into digital platforms that promise accountability and speed.

Assessing the Clothing & Accessories sector, more than 80% of spending in that sector flows straight into retail media, paid search and social platforms. The platforms are capturing virtually all the growth. Technology & Electronics follows a similar pattern.

The result: a two-speed market. Legacy categories spend at steady levels. New categories are emerging, and their revenue flows almost entirely to the major platforms.

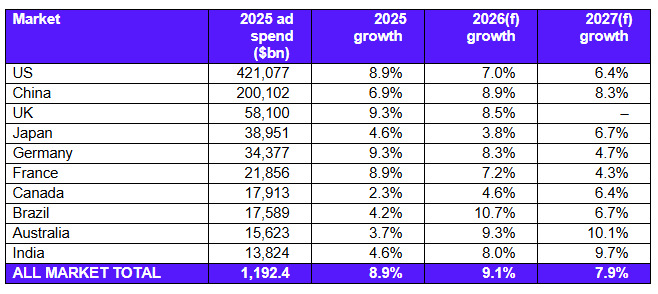

The US dominates, accounting for 35.3% of global ad spending at $421.1bn this year, up 8.9%. Next year is expected to deliver 7.0% growth, supported by the men’s FIFA World Cup and midterm elections. By 2027, the US market will reach $479.4bn, up 6.4%.

China ranks second with $200.1bn and 6.9% growth this year, accounting for 16.8% of the global total. Growth accelerates to 8.9% next year, then eases to 8.3% in 2027 as economic prospects improve.

The UK overtook Japan in 2022 and now ranks third at $58.1bn, up 9.3% in 2025, with 8.5% growth forecast for next year. The top 10 advertising markets account for 70.4% of total global spending in 2025.

Elsewhere in Europe, Germany grows 9.3% to $34.4bn this year, France rises 8.9% to $21.9bn, and Spain jumps 9.8% to $10.7bn. Canada and Mexico will benefit from hosting FIFA World Cup games next year.

WARC built these projections from data across 100 markets using a neural network analysing over two million data points. The takeaway: Advertising has decoupled from traditional economic indicators, and Big Tech is positioned to grab most of the growth ahead.

Impressive breakdown of how ad spend has completley decoupled from traditional economic indicators. The point about digital-native categories creating a "second growth engine" is someting I've noticed firsthand with smaller ecommerce brands who basically bypass traditional media entirley. What's especially intresting is how this concentration actually makes smaller players more vulnerable since the big three can essentially dictate pricing and access to increasingly expensive ad inventory.